![]()

I am a fifth-year Ph.D. candidate in finance at Kellogg School of Management, Northwestern University (degree expected in 2027). My research interests include macrofinance, financial intermediation, and financial stability.

Before starting my Ph.D., I was a financial analyst at Bank of Japan and a research associate at the Yale Program on Financial Stability.

Contact: junko.oguri[at]kellogg.northwestern.edu

Research Projects

Ample Reserves for Whom? The Role of Foreign Banks in U.S. Monetary Policy Implementation with Cristoforo Pizzimenti (SSRN link)

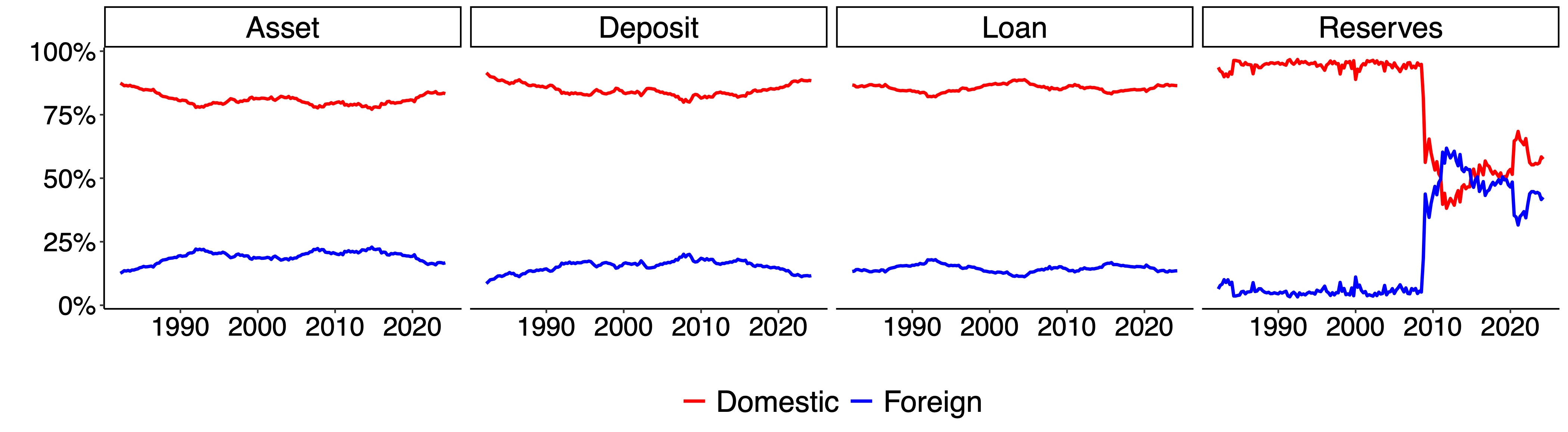

Share of Balance Sheet Components: Domestic Banks and Foreign Banks

- Presentations: MFA (2026, scheduled), AFA Poster Session (2026), WasedaU (2025), Chicago Fed (2025), Dallas Fed (2025), Kellogg Finance Brown Bag (2024, 2025), Northwestern Macro Lunch Seminar (2024), Inter-Finance PhD Seminar (2024, 2025)

- Fellowship: 2025 ECB Lamfalussy Research Fellowship

Abstract (click to expand)

This paper examines how foreign banks constrain the Federal Reserve’s ability to shrink its balance sheet under the ample-reserves framework. Although they represent a small share of U.S. banking assets, foreign banks hold a disproportionately large share of reserves. Their demand is highly elastic, shaped by global regulatory asymmetries and cross-border arbitrage incentives. Using regulatory and high-frequency data, we document systematic differences in reserve management across bank types. Exploiting exogenous variation in supply shocks, we show that reserve demand is heterogeneous and asymmetric across policy regimes: foreign banks absorb most inflows during quantitative easing (QE), but adjust less during quantitative tightening (QT), when large domestic banks shed reserves more actively. We develop a heterogeneous-demand model that links these behaviors to the aggregate reserve demand curve and shows that uncertainty specific to foreign banks increases the Federal Reserve’s optimal reserve supply during QT.

Monetary Policy and Firm Financing in Emerging Markets with Pablo Sanchez and Rodolfo Erasmo Oviedo Moguel

Supply Chain of Synthetic Dollar Funding with Jialu Sun