![]()

I am a fifth-year Ph.D. candidate in finance at Kellogg School of Management, Northwestern University (degree expected in 2027). My research interests include macrofinance, financial intermediation, and financial stability.

Before starting my Ph.D., I was a financial analyst at Bank of Japan and a research associate at the Yale Program on Financial Stability.

Contact: junko.oguri[at]kellogg.northwestern.edu

Research Projects

Ample Reserves for Whom? The Role of Foreign Banks in U.S. Monetary Policy Implementation with Cristoforo Pizzimenti

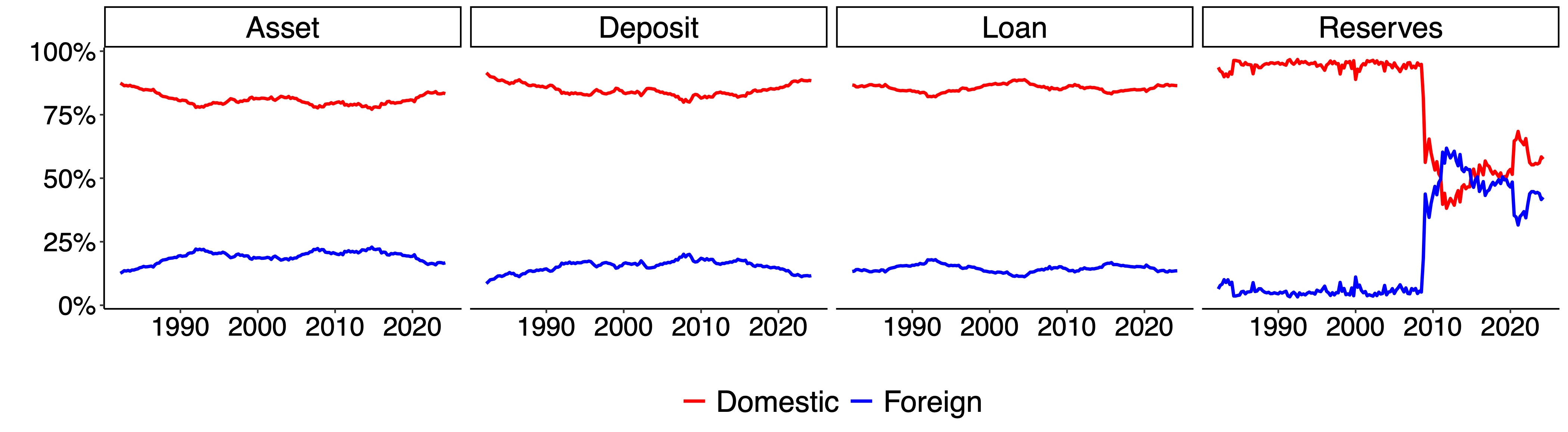

Share of Balance Sheet Components: Domestic Banks and Foreign Banks

Abstract (click to expand)

This paper shows that foreign banks are the marginal holders of reserves in the U.S. ample-reserves system. Despite holding a minority share of U.S. banking assets, foreign banks hold nearly half of total reserves and exhibit highly elastic demand, responding aggressively to arbitrage opportunities between interests on reserves and funding rates. This sensitivity is amplified by internal liquidity transfers between their branches and foreign headquarters. Using high-frequency shocks to reserve supply, we confirm that foreign banks absorb the bulk of adjustments to aggregate reserve fluctuations. We develop a tractable model that formalizes these findings and show that uncertainty originating from foreign banks, such as quarter-end window-dressing, raises the optimal reserve supply by the Fed. These results highlight the importance of institutional heterogeneity in reserve demand. In an ample-reserves framework, effective policy implementation depends not only on the aggregate level of supply, but also on the identity of the marginal holder.

- Presentations: Dallas Fed (2025), Kellogg Finance Brown Bag (2024, 2025), Northwestern Macro Lunch Seminar (2024), Inter-Finance PhD Seminar (2024)

- Fellowship: 2025 ECB Lamfalussy Research Fellowship

- Monetary Policy and Firm Financing in Emerging Markets with Pablo Sanchez and Rodolfo Erasmo Oviedo Moguel